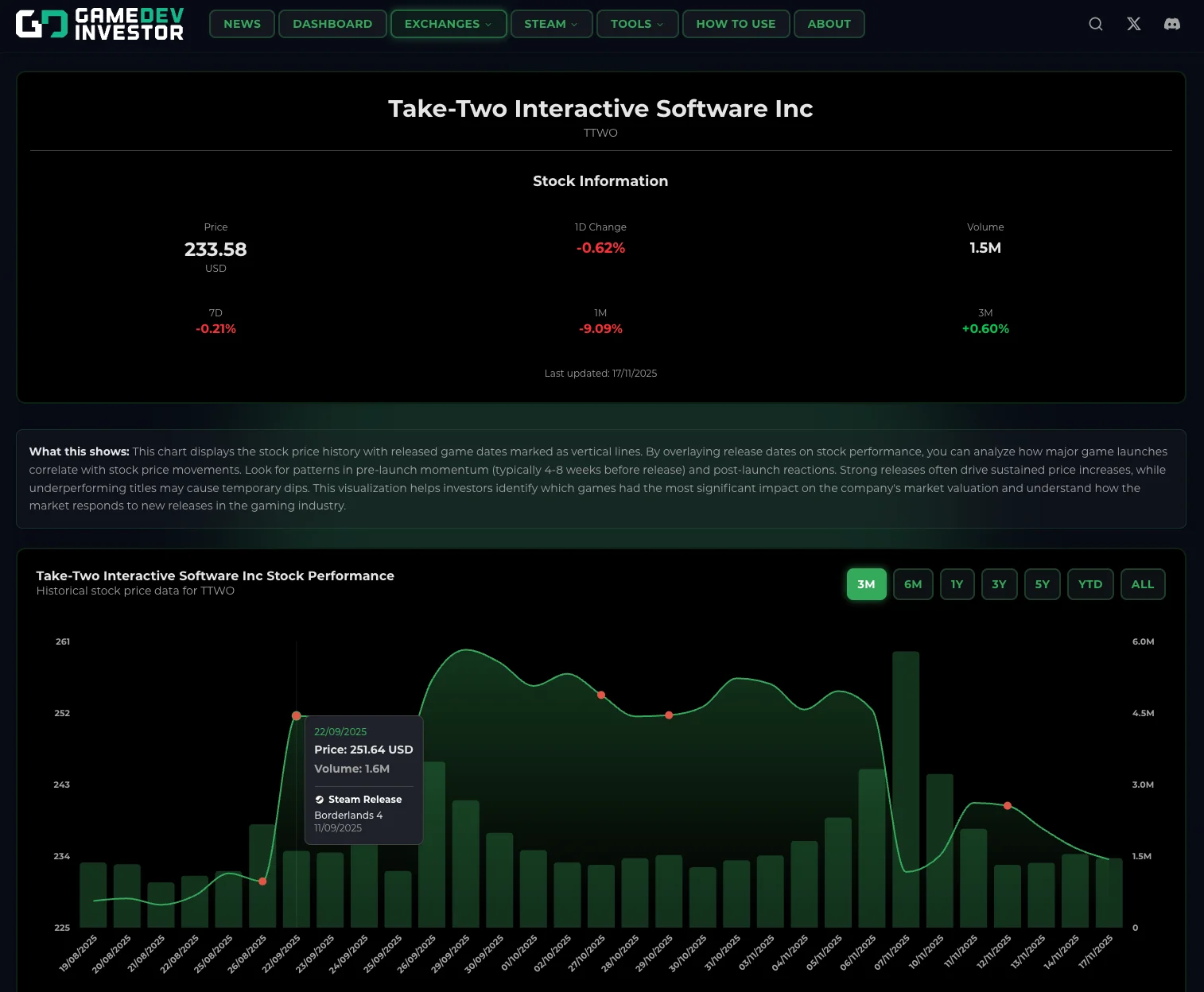

GamedevInvestor Adds Take-Two Interactive: Profiling a Content Giant Ahead of GTA VI

GamedevInvestor now tracks Take-Two Interactive, analysing its diversified portfolio, GTA VI pipeline, recurrent revenue model and key risks for long-term investors.

GamedevInvestor Adds Take-Two Interactive: Profiling a Content Giant Ahead of GTA VI

Why Take-Two Interactive Joins the GamedevInvestor Coverage Universe

Take-Two Interactive Software, Inc. (NASDAQ: TTWO) is one of the most important publishers in global gaming, combining blockbuster console and PC franchises with a large mobile portfolio. Through labels such as Rockstar Games, 2K, Private Division and Zynga, the company operates across premium, live-service and free-to-play segments.

By adding Take-Two as a tracked company, GamedevInvestor formally brings one of the sector’s key content platforms into its analytics universe. This allows investors to view Take-Two’s fundamentals, key titles and pipeline alongside mid-cap and niche publishers already covered on the platform.

Business Model and Portfolio Structure

Take-Two’s model is built around a mix of premium franchises and high-margin recurrent consumer spending (RCS):

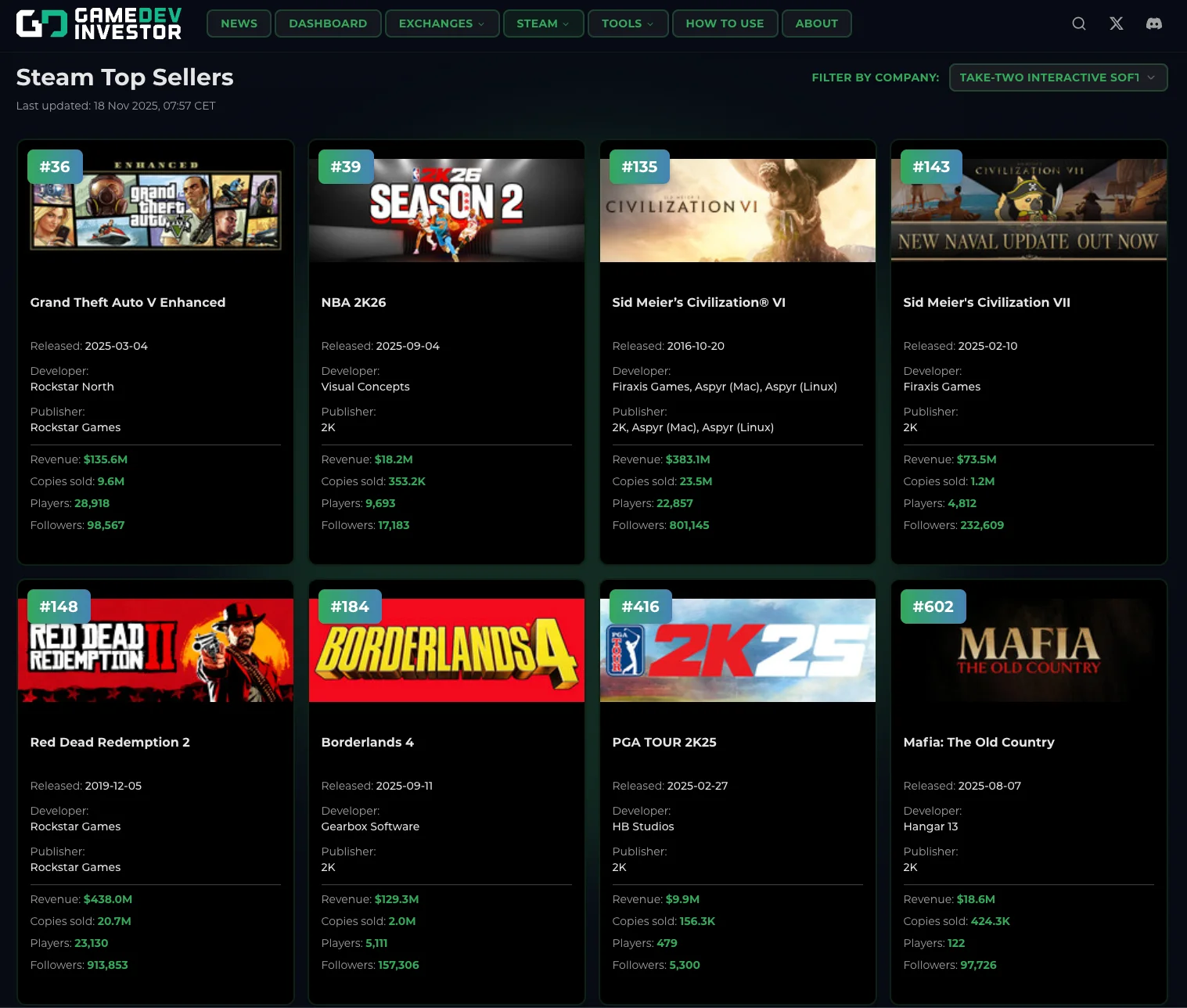

• Rockstar Games: Grand Theft Auto, Red Dead Redemption and other open-world IP.

• 2K: Sports and core titles including NBA 2K, WWE 2K, PGA Tour 2K, Civilization and Borderlands.

• Zynga: Mobile games such as Toon Blast, Toy Blast, Empires & Puzzles and Words With Friends.

The company has increasingly shifted value capture toward recurrent consumer spending – in-game purchases, virtual currency and add-on content. In fiscal year 2025, Net Bookings from recurrent consumer spending accounted for roughly 80% of total Net Bookings.

Financial Profile: Scale, Growth and Bookings Mix

Take-Two is firmly positioned in the global top tier by revenue:

• Trailing twelve-month revenue stands around USD 5.8 billion.

• Fiscal 2025 total Net Bookings grew 6% year on year to USD 5.65 billion.

Recurrent consumer spending has grown faster than overall bookings, reaching about 79–80% of total Net Bookings in recent quarters.

However, GAAP profitability has been pressured by amortisation of acquired intangibles, restructuring charges and increased investment in future titles.

Strategic Pipeline: GTA VI and Beyond

The single largest strategic driver for Take-Two is Grand Theft Auto VI. Rockstar has announced the game for current-generation consoles, now scheduled for 19 November 2026.

Each delay has caused volatility, but analysts largely view the changes as quality-driven.

Other contributors include:

• NBA 2K annual releases

• Ongoing performance of GTA Online and Red Dead Online

• Zynga’s casual portfolio stabilising revenue between major launches

Investment Case: Strengths

• Franchise durability: GTA and Red Dead remain among the most valuable IP in gaming.

• High share of live and recurrent spending: Around 80% of bookings.

• Portfolio diversification: 2K and Zynga reduce concentration risk.

Key Risks and Sensitivities

• GTA VI concentration risk

• Production and delay risk

• Mobile exposure through Zynga

• Complex accounting and GAAP volatility

How GamedevInvestor Will Track Take-Two

GamedevInvestor will:

• Track sentiment and engagement for GTA Online, Red Dead Online and NBA 2K

• Monitor GTA VI marketing milestones

• Compare bookings and RCS trends to publisher peers

• Integrate Take-Two into future GDI Forecast models

Strategic Conclusion

Take-Two is a natural addition to GamedevInvestor’s tracked universe due to its scale, portfolio strength and major upcoming catalysts. With GTA VI approaching in late 2026 and a robust live-service foundation, Take-Two offers a compelling combination of stability and event-driven upside.

Feel free to explore Take-Two Interactive