Poland’s Biggest Game Releases Under the Microscope: What Steam Data Reveals to Investors

An investor-focused analysis of major Polish game releases, using wishlist, follower, and sales rankings to uncover performance patterns with the GDI Benchmark toolkit.

Scope and Market Context

This article focuses on major PC releases from Polish publicly listed game developers over the last 2–3 years, a period marked by rising production budgets, tougher competition on Steam, and far less tolerance for underperforming launches.

Studios such as 11 bit studios, Bloober Team have released flagship titles during this timeframe, providing a clean dataset to compare outcomes under similar market conditions. Crucially, this period also delivered one of the clearest recent success stories: StarRupture.

From an investor’s perspective, the key question is no longer whether a game launches, but how efficiently pre-release interest converts into sustained post-launch revenue. Steam-derived metrics make that conversion process visible almost in real time.

Pre-Release Demand: Wishlist Rankings as the First Filter

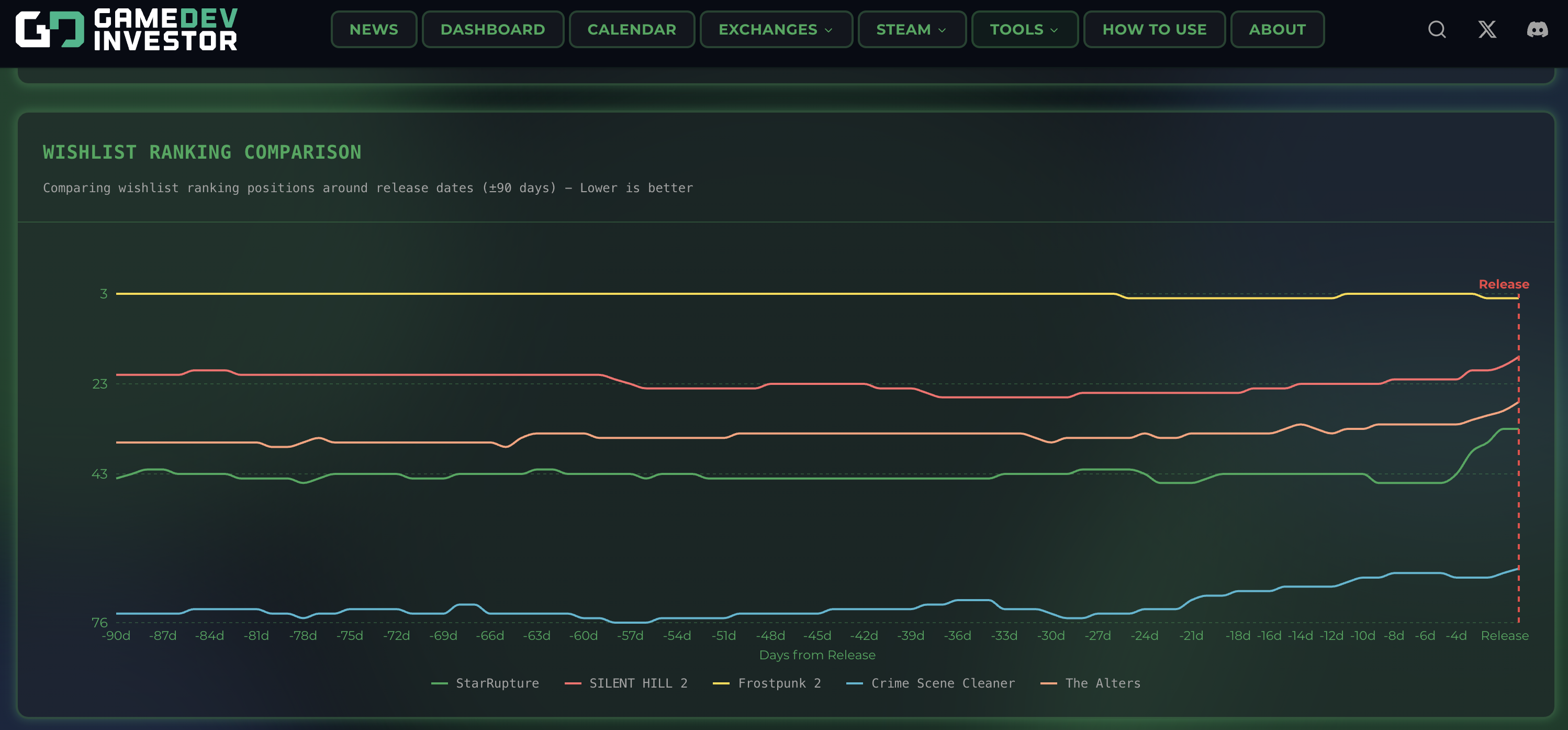

Wishlist rankings ahead of release remain the most reliable indicator of global demand breadth. Games entering launch windows with high and stable wishlist positions typically benefit from stronger algorithmic exposure and higher day-one conversion.

Wishlist Ranking Comparison (±90 days around release)

Purpose: Compare pre-release demand positioning across recent Polish releases

Wishlist Ranking Comparison (±90 days around release)

Purpose: Compare pre-release demand positioning across recent Polish releases

In the recent dataset, Frostpunk 2 entered release with elite wishlist positioning, reflecting massive franchise awareness. StarRupture, while operating at a smaller absolute scale, showed remarkably stable and improving wishlist ranks, signaling efficient community building rather than short-term hype spikes.

For investors, stability matters as much as rank. Flat, disciplined curves generally outperform late-stage marketing-driven surges when translated into sales.

Release Validation: Global Top Sellers as a Revenue Proxy

The moment of truth arrives immediately after launch. Steam’s Global Top Sellers ranking reflects actual revenue velocity, not expectations or sentiment.

Top Sellers Ranking Comparison after Release

Purpose: Visualize revenue strength and post-launch decay curves

Top Sellers Ranking Comparison after Release

Purpose: Visualize revenue strength and post-launch decay curves

This is where StarRupture clearly stands out as a recent success story. The game not only entered strong Top Sellers positions shortly after release, but also maintained competitive rankings relative to much larger-budget titles. The slope of its post-launch decline is shallow, indicating durable demand rather than a short-lived launch spike.

By comparison, several higher-profile releases show steeper ranking deterioration, a pattern often associated with weaker retention, mixed reviews, or limited content depth. For investors, these decay curves often precede disappointing long-tail revenue.

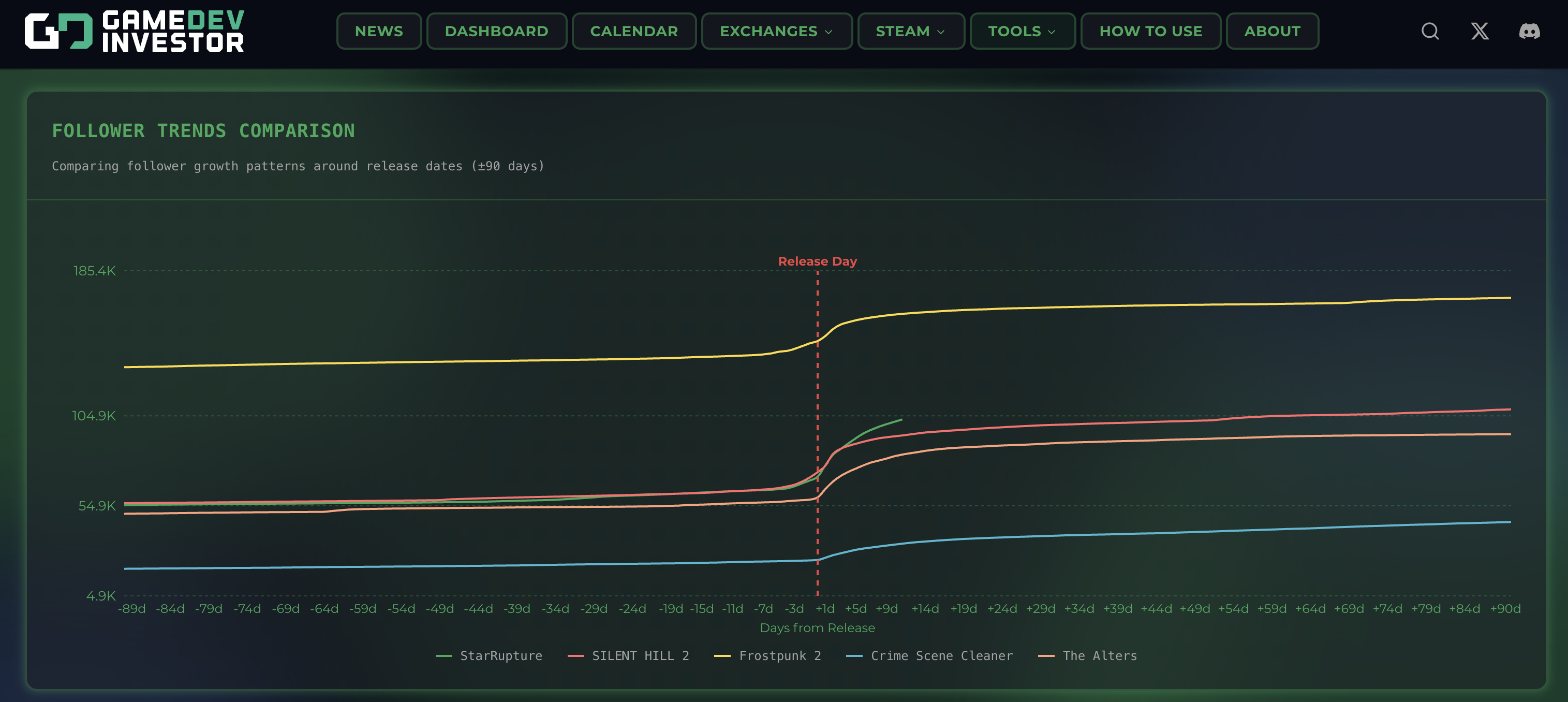

Followers: Measuring Durable Audience Growth

Follower counts are frequently overlooked, yet they provide one of the clearest signals of franchise and DLC potential. Unlike wishlists, followers persist well beyond launch and directly influence future monetization.

Follower Trends Comparison around Release Day

Purpose: Show permanent vs temporary audience expansion

Follower Trends Comparison around Release Day

Purpose: Show permanent vs temporary audience expansion

Recent Polish releases display sharply different post-launch follower behavior. Strong performers exhibit a structural step-up around release day, permanently raising their baseline audience. StarRupture again fits this pattern, converting launch visibility into lasting community growth rather than transient attention.

Games that fail this test often show a short-lived bump followed by stagnation, limiting upside beyond the initial sales window.

Cross-Metric Alignment: How Real Winners Look in Data

When wishlist positioning, Top Sellers performance, and follower growth align, the probability of commercial success rises sharply. Over the last 2–3 years, only a subset of Polish releases achieved this alignment.

StarRupture is a textbook example of balanced execution: realistic pre-release expectations, strong post-launch monetization, and durable audience expansion. This combination is far more investable than isolated peaks in any single metric.

Where divergence appears, it often signals execution risk. Strong wishlists paired with weak seller rankings raise pricing or quality concerns. Solid sales without follower growth suggest limited long-term monetization potential.

Investor Takeaways from Recent Polish Launches

Steam metrics increasingly act as early financial indicators, well ahead of quarterly disclosures. For investors tracking Polish game studios, these signals help differentiate between sustainable operators and one-off successes.

Tools like the GDI Benchmark make these comparisons systematic rather than anecdotal. By standardizing time windows and normalizing rankings, investors can objectively assess which releases truly worked in the current market environment.

Conclusion

The last 2–3 years of Polish game releases confirm a simple rule: execution quality is visible immediately in data. Titles like StarRupture demonstrate that disciplined scope, strong community building, and solid launch execution can outperform far larger productions on a risk-adjusted basis.

For investors, relying on trailers or press coverage is no longer sufficient. Hard Steam data, interpreted through structured benchmarks, has become an essential layer of modern game industry analysis.